Table of Contents

Understanding your company’s financial health is like reading a map to success.

Imagine this: Every sale you make is a step forward, but how quickly you get paid on those sales is crucial in seeing your business journey progress.

Now enter the Days Sales Outstanding (DSO) – The compass guiding your company’s financial direction.

“The most important thing to do if you find yourself in a hole is to stop digging.” – Warren Buffett

Thus, DSO tells you if you’re digging deeper or climbing higher.

For example, American companies typically spend around 36 days collecting their accounts receivable.

That’s similar to waiting a month and a half before you can use the money you’ve earned!

Understanding DSO becomes vital for a clearer understanding of your cash flow.

So, buckle up as we embark on a journey through the ins and outs of DSO.

Days Sales Outstanding (DSO) is a complex term, but it’s simply a method companies use to gauge how fast they receive payments for their sales.

Think of it as monitoring your wallet after loaning money to a friend—naturally, you prefer getting it back sooner rather than later, right?

So, what is DSO exactly?

Think of it as a speedometer for your business’s cash flow.

To figure out DSO, you need to know a few things.

Running a business is more than just making sales. It’s also about ensuring those sales translate into actual money in your pocket. That’s where Days Sales Outstanding (DSO) steps in as a vital measure.

But why is it so crucial?

DSO reflects your company’s financial well-being. It reveals the average time your customers take to settle their invoices. A reduced DSO typically signifies faster payments, positively impacting your cash flow.

Imagine your sales are flourishing, but the money is tied up in unpaid invoices. That’s where DSO helps.

It helps determine if your business has enough cash to cover daily operations, pay suppliers, or invest in growth. A high DSO might indicate potential liquidity issues.

A sudden increase in DSO could signal trouble. It might point to issues with collection processes, customer creditworthiness, or changes in market behavior.

Businesses thrive on better financial decisions. DSO provides crucial data for making more intelligent choices.

DSO guides strategic moves, such as negotiating better terms with suppliers, adjusting credit policies, or investing in collection technologies.

DSO is a key performance indicator for investors and stakeholders. A low DSO signifies efficiency in managing receivables and demonstrates financial stability.

This can attract potential investors and strengthen relationships with existing ones.

It’s not just about your finances; DSO also illuminates customer relationships. Understanding payment behaviors helps tailor strategies.

For instance, incentivizing early payments might improve relations with prompt-paying clients.

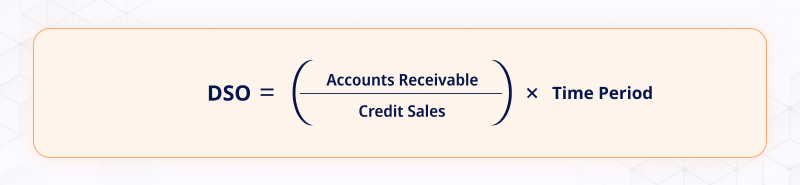

Here is how to calculate Days Sales Outstanding (DSO): it involves a simple formula that gives businesses a clear insight into their receivables’ efficiency and the average time it takes to collect payments.

Understanding its components and practical application is pivotal in managing financial health.

Accounts Receivable signifies the sum customers owe a company for goods or services received but not settled for. This value is commonly listed on the balance sheet and includes invoices awaiting payment within a specific period.

Accounts Receivable signifies the sum customers owe a company for goods or services received but not settled for. This value is commonly listed on the balance sheet and includes invoices awaiting payment within a specific period.

The Time Period considered in the DSO calculation formula can vary based on preferences or industry standards. It usually spans a month, a quarter, or a year and represents the duration for which DSO is computed.

Let’s consider a company with $50,000 in accounts receivable and credit sales totaling $200,000 for the previous month (30 days).

To calculate DSO:

On average, it takes the company approximately 7.5 days to collect customer payments.

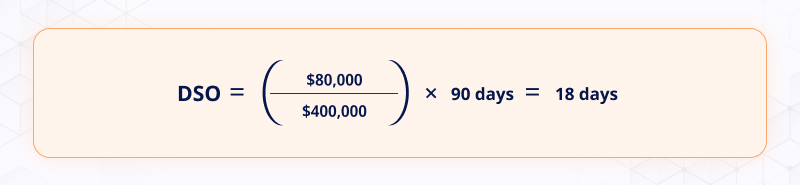

Another scenario involves a business with $80,000 in accounts receivable and $400,000 in credit sales over a quarter ( 90 days ):

Hence, in this case, the company takes, on average, about 18 days to convert credit sales into cash receipts.

These examples showcase how the DSO formula, by relating accounts receivable to credit sales over a specific time frame, provides a metric for evaluating a company’s effectiveness in collecting payments.

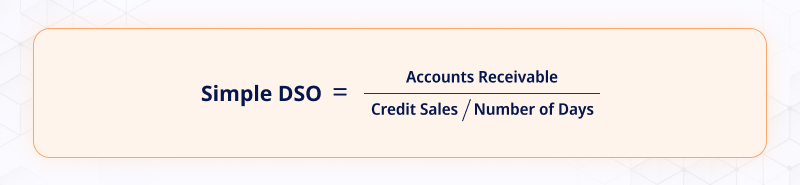

There isn’t just one method when calculating Days Sales Outstanding (DSO).

Businesses use three different approaches:

This method is super easy. You divide the total amount of money owed to your business (Accounts Receivables) from sales on credit by the average daily sales. The formula looks like this:

For instance, if your accounts receivable is $10,000, and your average daily credit sales are $1,000 , your simple DSO would be ten days .

It’s a quick way to gauge how long it takes to collect payments on average.

This method considers sales made at different times, giving more weight to recent sales. Instead of just taking an average, you calculate a weighted average based on the aging of your accounts receivable.

Here’s a simple way to understand it: if a $500 sale from yesterday is more likely to be paid soon than a $500 sale from three months ago, the weighted DSO considers this.

It involves bucketing your outstanding invoices by age and multiplying the days outstanding by the amount due in each bucket. The sum of these products gives you the weighted DSO.

Rolling DSO takes a dynamic approach by measuring DSO over a specific period, often a month, and updating it daily.

Instead of looking at a snapshot at the end of a period, it keeps evolving, reflecting changes in sales and collections.

For instance, if on day 1, your DSO is 30, and on day 2, you collect payments for sales made on day 1, your DSO for day two will reflect this change in real time.

Rolling DSO offers a more current view of how efficiently you’re collecting payments, making it useful for businesses with fluctuations in sales and collections.

Each method has its perks, and the best one for your business depends on factors like the nature of sales, collection patterns, and the level of detail needed for analysis.

Choosing the correct method helps you better understand and manage your cash flow.

Calculating Days Sales Outstanding (DSO) can be simplified and made more efficient with the help of various automated tools and software available in the market. These tools streamline the calculation process and offer valuable insights into your business’s financial health.

Manually calculating DSO involves intricate data gathering, computations, and analysis. However, with the advancement of technology, dedicated software and tools have emerged, simplifying this complex task.

One such tool that stands out in simplifying DSO calculations is Invoicera.

It’s designed to handle invoice creation and payments and provides a comprehensive DSO calculation module.

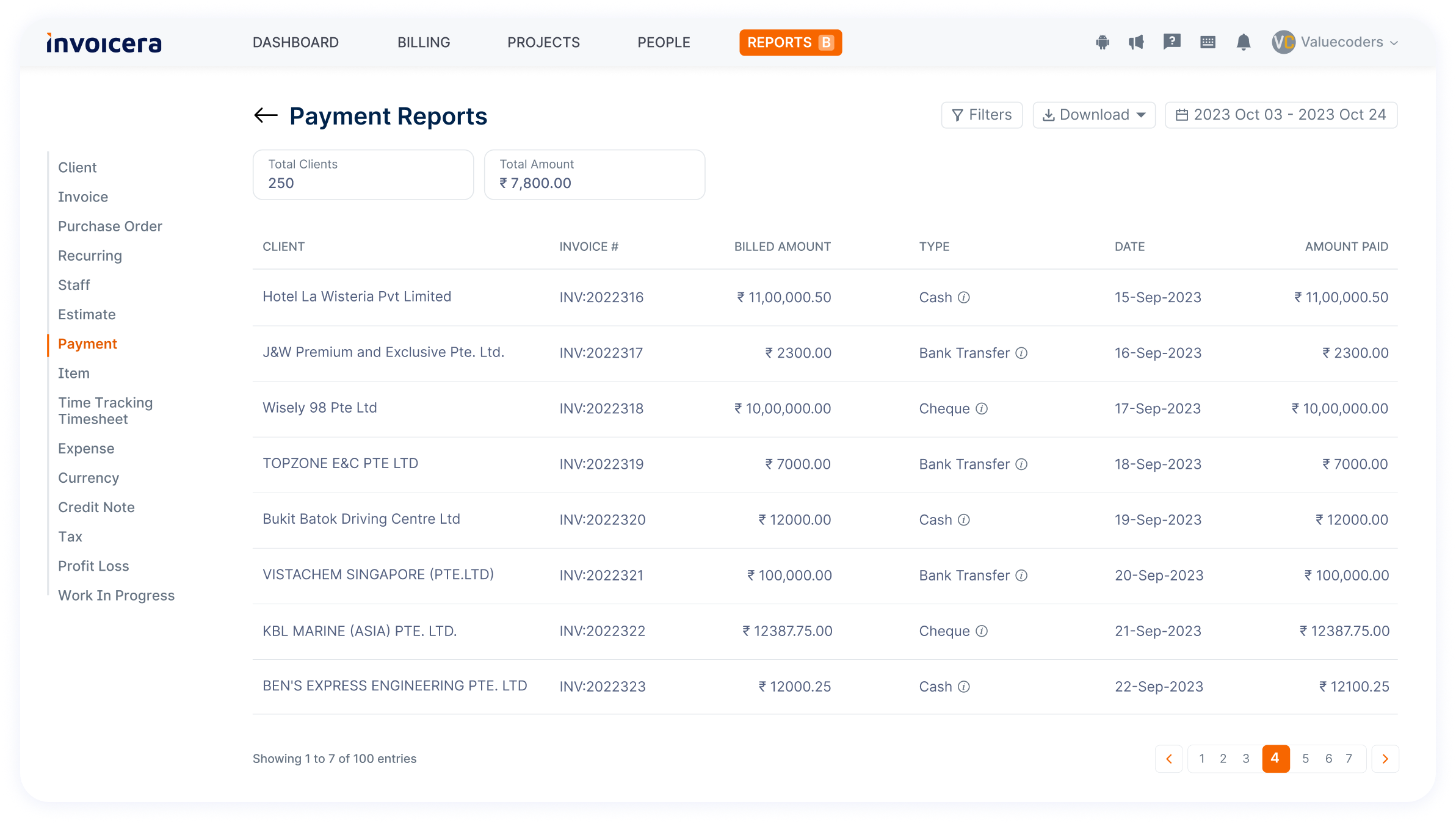

Invoicera, a comprehensive invoicing and billing software, offers a streamlined way to effortlessly calculate Days Sales Outstanding (DSO). By harnessing its features, you can gain valuable insights into your business’s financial health and customer payment trends.

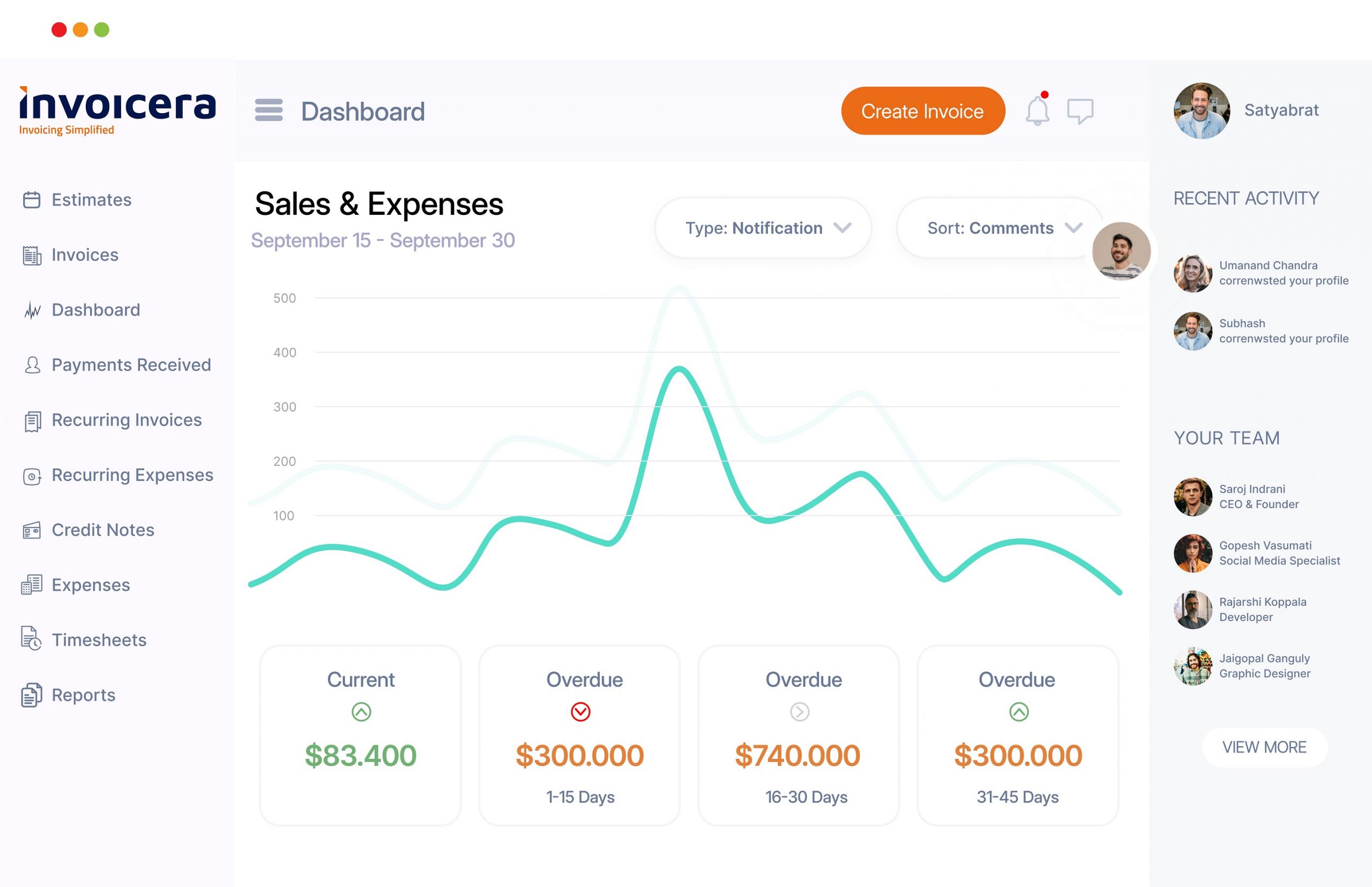

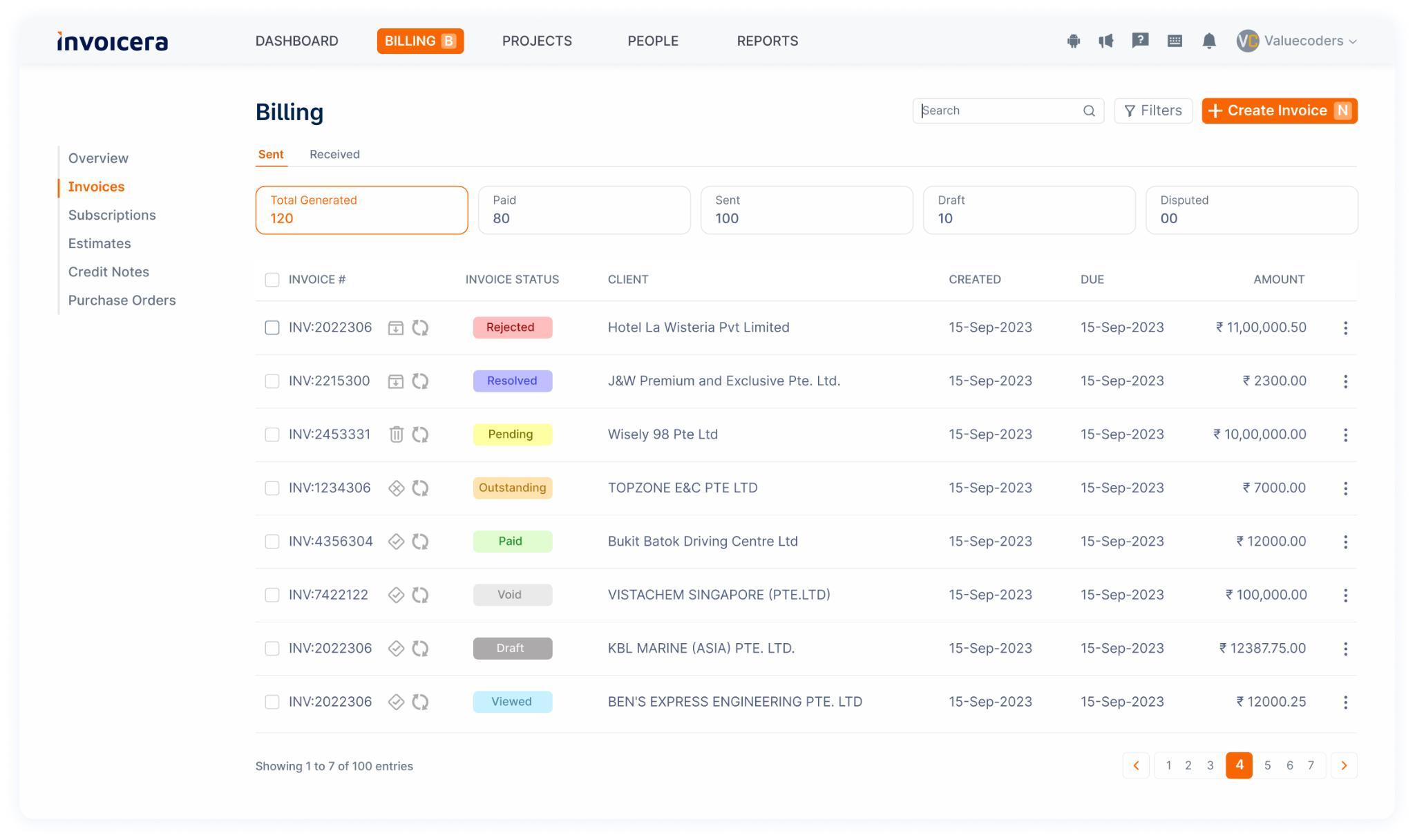

Start by logging into your Invoicera account. The dashboard is your control center, where you’ll find tools and features for managing invoices, payments, and business analytics.

Look for the ‘ Reports’ or ‘Analytics’ tab on the dashboard. Invoicera simplifies access to various reporting functionalities in this section.

Select the range of dates that you’d like to use as the starting and ending points for generating comprehensive reports on Days Sales Outstanding (DSO).

Invoicera goes further by visually representing your DSO performance over time. Graphical representations and trends help spot patterns, potential issues, and areas for improvement.

Ready To Gain Control Over Your Business's Cash Flow?Streamline Your DSO Calculations With Invoicera

Using automated tools for managing Days Sales Outstanding (DSO) can be a game-changer.

Let’s look at why:

They’re prone to mistakes. But with automated tools, say goodbye to those errors!

These tools work with precision, doing the math flawlessly every time. They gather data, crunch the numbers, and spit out accurate DSO figures. Bye-bye, human error!

Imagine the time spent doing calculations manually—hours tick away, right?

But with automated tools, it’s a whole different story.

They zip through the process in a blink. No more crunching numbers tediously; these tools do it swiftly, leaving you with more time for crucial tasks.

One size doesn’t fit all, especially in business. Luckily, these automated tools understand that. They come with options to tailor settings to your specific needs.

Remember the following things when you opt for a DSO calculation tool.

You want a tool that fits your budget and grows with your business. Some tools might seem affordable initially, but watch out for hidden costs or limitations as your business expands.

Scalability is vital. Imagine if your tool can handle your current needs, but in a few months, it starts to lag. That’s why it’s crucial to balance cost with scalability.

Your business uses various software and systems. A good DSO tool should easily integrate with these. It’s like fitting puzzle pieces together—they should work seamlessly.

If your DSO tool doesn’t sync well with your existing systems, it might create more work for your team and cause unnecessary headaches.

Imagine using a tool as complicated as solving a Rubik’s Cube blindfolded. Not fun, right? Look for a tool that’s user-friendly and intuitive. You want something your team can easily navigate without needing a computer science degree.

Also, check what kind of support the tool offers. Good support is required if you ever have issues or have questions.

Ultimately, the right DSO calculation tool should be an extension of your team that helps you make smarter decisions without causing extra stress. So, consider these factors when choosing, and you’ll find the tool that fits like a glove for your business.

Want To Unlock Valuable Insights Easily?Get Insights With User-Friendly Dashboard

Focus on clarity and consistency to streamline your Accounts Receivable (AR) processes. Ensure that invoices are accurate, clearly detailing the services or products provided, payment terms, and due dates. This transparency helps in prompt payment.

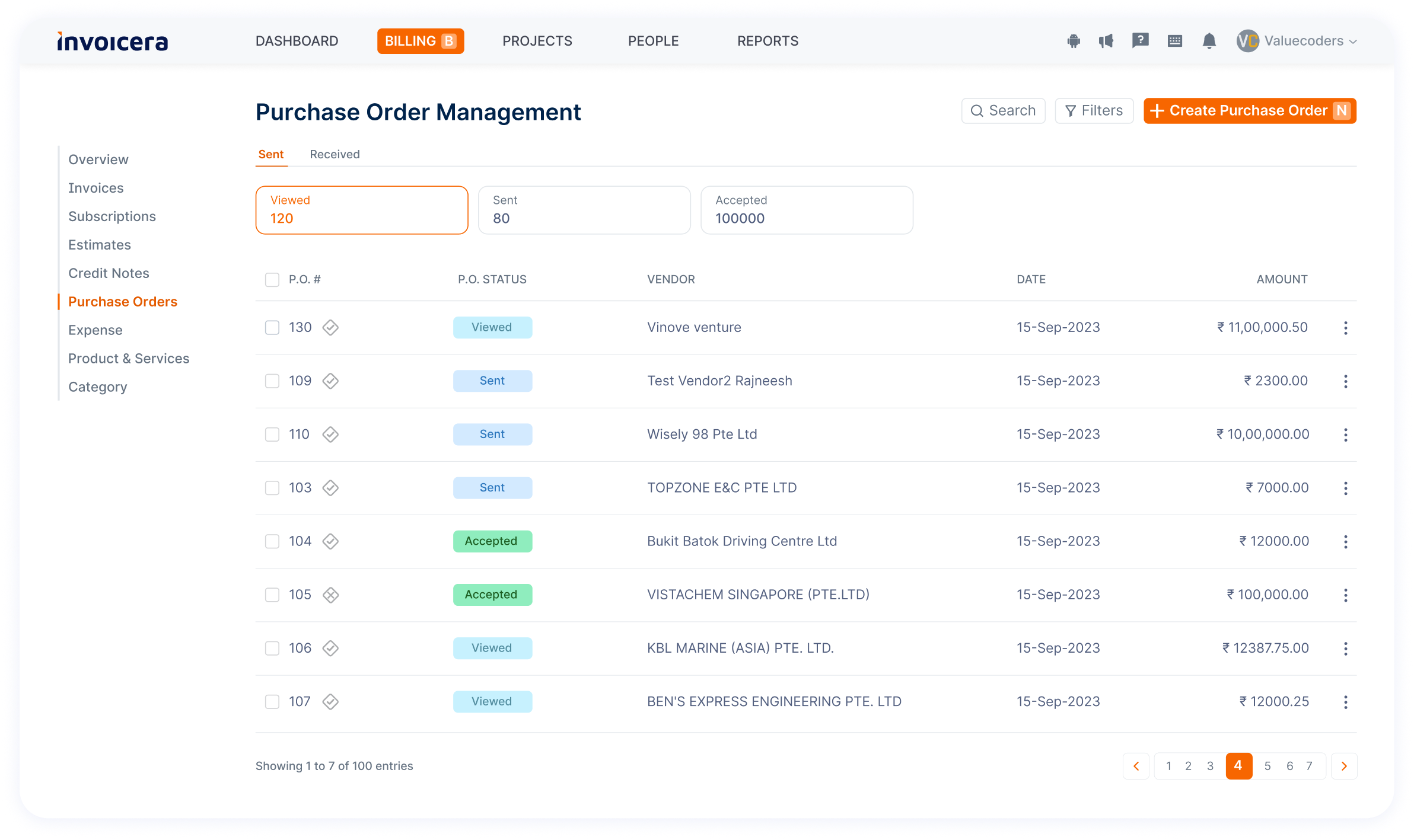

Consider utilizing a comprehensive platform like Invoicera, which simplifies invoice generation, tracks payments, and sends reminders automatically.

Efficiency in billing and collections accelerates cash inflow. Implement a system that promptly sends invoices when the service is provided or the product is delivered. Automating reminders for pending payments can significantly reduce delays.

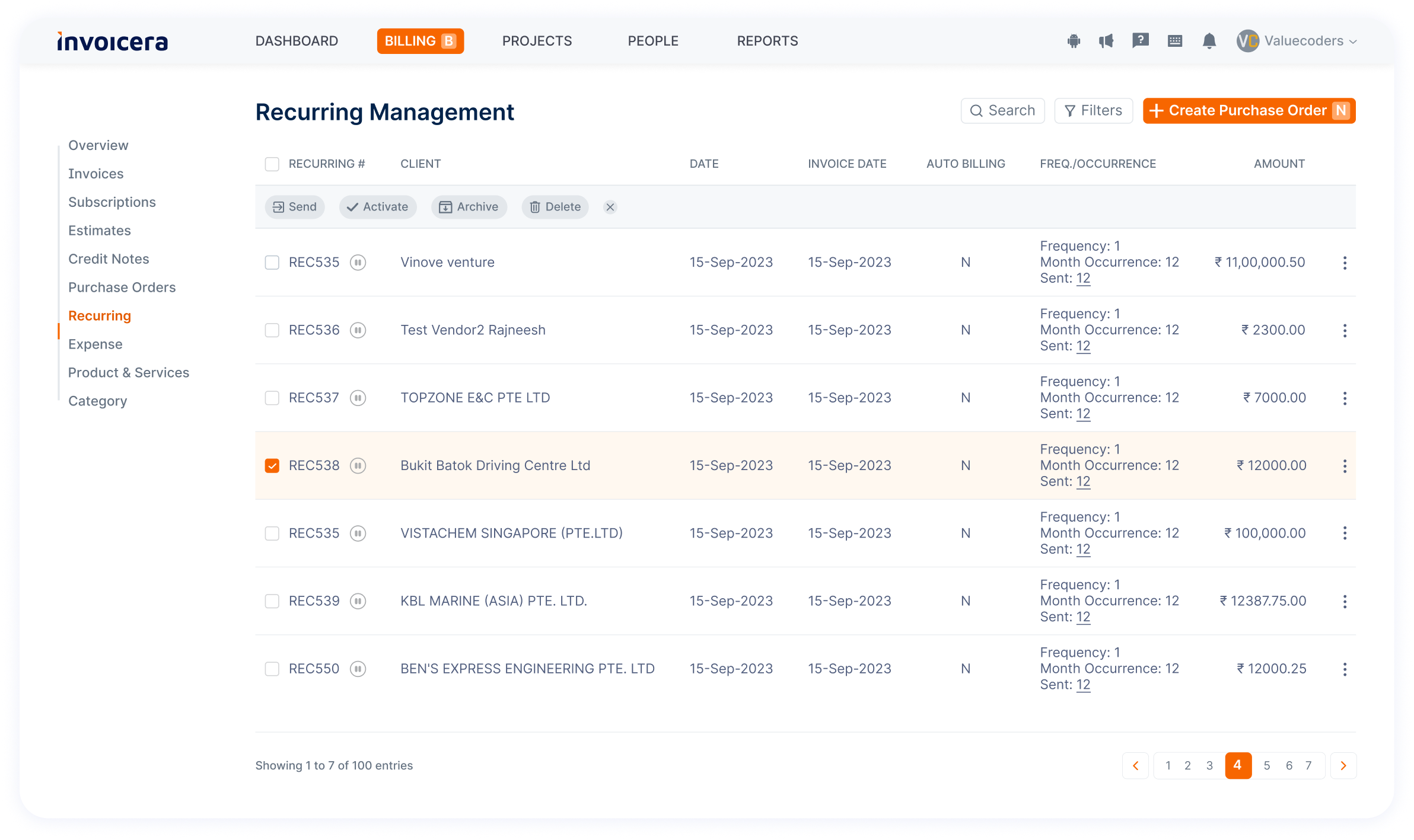

Invoicera offers recurring billing and customizable payment reminders, streamlining the entire billing and collection process.

Negotiating favorable payment terms can positively impact DSO. Extend your negotiation skills to discuss flexible payment schedules with clients or suppliers.

Invoicera’s platform enables you to customize payment terms as per agreements and track adherence to these terms efficiently.

Embracing technology and automation can revolutionize your DSO management. Invoicera’s intuitive dashboard and reporting functionalities provide insights into outstanding payments, helping you make informed decisions.

Automation reduces manual errors, ensures timely invoicing, and expedites payment collection, ultimately reducing DSO.

Choose Invoicera To Optimize Accounts Receivable

What’s an ideal DSO value?

There’s no one-size-fits-all ideal DSO value, as it varies by industry. However, a lower DSO generally indicates faster collections, which is beneficial.

How often should I calculate DSO?

Calculating DSO monthly or quarterly to track changes and taking timely actions if needed is advisable.

What impacts DSO apart from sales and receivables?

Sales terms, customer payment behavior, and market conditions significantly impact DSO.

How can I improve a high DSO?

Optimizing billing processes, incentivizing early payments, and negotiating better customer terms can help lower a high DSO.